Kroton No.2 Limited was incorporated in June 2009. The company name was changed to National Petroleum Company of Papua New Guinea Kroton Limited (NPCP Kroton) in September 2010.

In 2014 NPCP Holdings Limited was incorporated as a subsidiary of the Independent Public Business Corporation (now Kumul Consolidated Holdings), in line with NEC Decision 264/2014. This decision also directed that all petroleum assets of the State held by other entities be transferred to NPCP Holdings Limited.

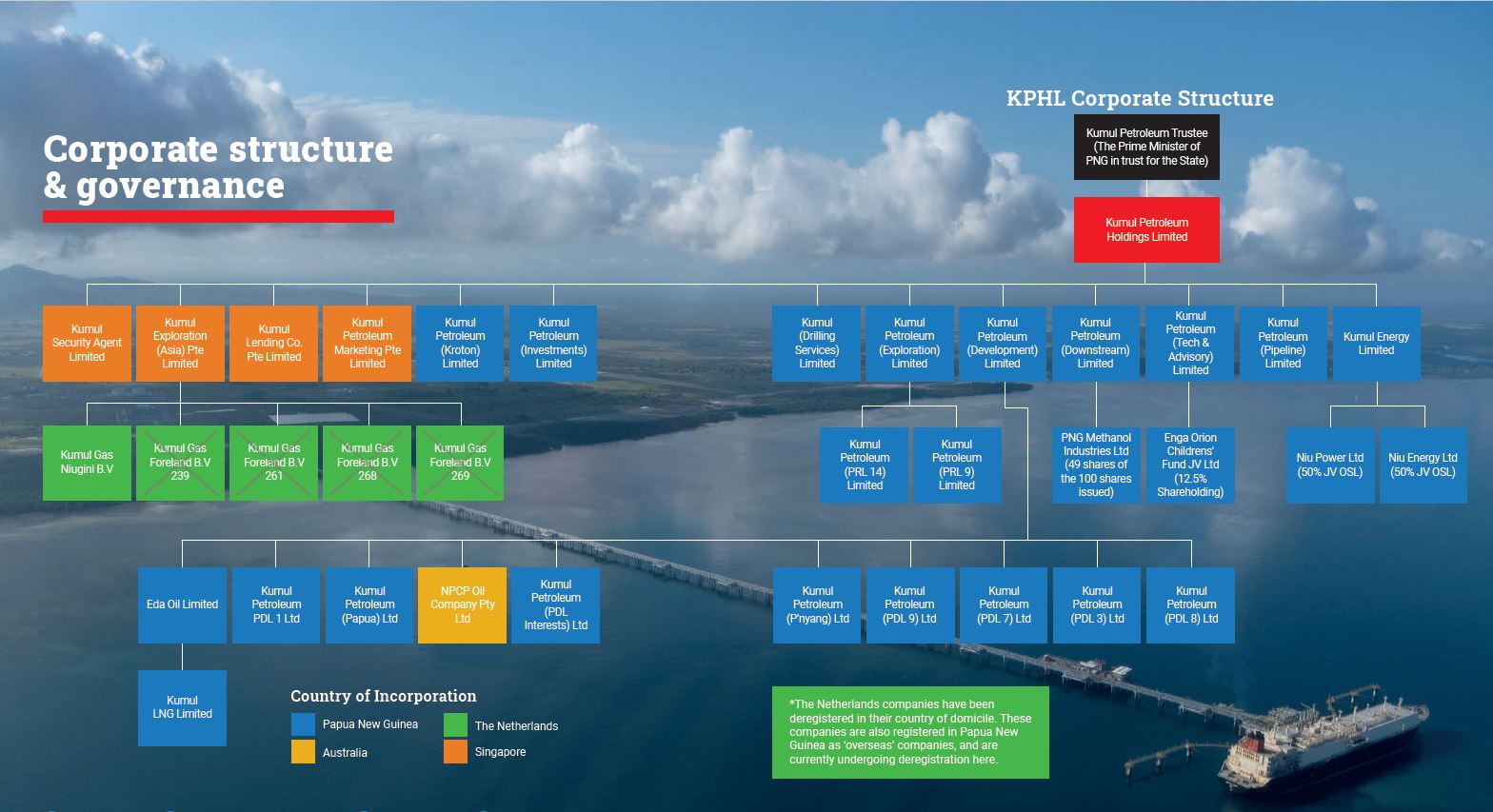

In 2015 the National Government determined that State assets be consolidated under a suite of Kumul sectoral companies – Kumul Consolidated Holdings, Kumul Mineral Holdings Limited and Kumul Petroleum Holdings Limited. In October 2015, NPCP Holdings Limited changed its name to Kumul Petroleum Holdings Limited (KPHL).

KPHL is the State nominee to participate in petroleum projects in the country in line with provisions of the Oil and Gas Act. Through subsidiary, Kumul Petroleum (Kroton) Limited KPHL holds a 16.57% interest in the PNG LNG Project, operated by ExxonMobil. Other subsidiaries hold interests in other petroleum licences.

Kroton Equity Option

The PNG LNG Project Umbrella Benefits Sharing Agreement (UBSA) signed by the State and other stakeholders in 2009 determined the distribution of statutory benefits to the various stakeholders in line with the Oil & Gas Act.

The UBSA also provided for a commercial option that enabled nominated project- impacted provincial governments and landowners to acquire additional indirect equity in the project through purchasing a 25.75% shareholding in the company holding the State’s interest in the PNG LNG Project, within a certain opportunity window.

The nominated provincial governments and landowners failed to secure finance to acquire these shares within the allotted opportunity time window; however, NEC considered that these stakeholders should still participate in and receive benefits from the PNG LNG Project. Kumul Petroleum Holdings organised vendor finance in 2016 for this purpose, known as the Kroton Equity Option, for these parties – the Kroton Equity Option Beneficiaries, until alternative commercial finance could be organised.

The structure of this vendor finance enabled the nominated Beneficiary Groups to receive a distribution even while this vendor finance was being repaid, a guaranteed distribution to be made available each year. At an average oil price above US$45/barrel an annual amount of US$10 million was to be paid to the Beneficiary Groups. At an average oil price above US$55/barrel an annual amount of US$15 million would be paid to the Beneficiary Groups; and at an average oil price above US$65/barrel an annual amount of US$20 million would be paid to the Beneficiary Groups.

Every year from 2017 funds for distribution accrued for the beneficiaries, except for 2020 when the oil price dropped below US$45/barrel. In December 2021, distributions accrued to that date were paid to the impacted provincial governments of Gulf, Central, Hela, Southern Highlands and Western. Funds for other beneficiary groups will be released once clan vetting and landowner identification exercises are complete.